How Are the Value HSA and Super Value HSA Unique?

The Value HSA and Super Value HSA have higher annual deductibles than the EPO, but lower employee payroll deductions. They allow you the opportunity to participate in an HSA, administered by Fidelity.

Here’s how it works:

Your HSA:

- MAPFRE contributes to your HSA:

- Value HSA – $500 individual / $1,000 family

- Super Value HSA – $1,000 individual / $2,000 family

- You may also make pre-tax contributions to your HSA

- MAPFRE’s contribution plus your contributions cannot exceed IRS annual limits (2024: $4,150 individual / $8,300 family)

Note for New Employees: MAPFRE’s contribution will be made after the first day of the month following your hire date. The annual employer contribution listed above will be divided by 12 and then multiplied by the number of months remaining in the calendar year. The amount deposited will be reduced for the number of months not employed with MAPFRE.

Medical plan coverage:

- Preventive care (like your annual physical) is covered at 100% throughout the year, with no deductible

- For other services, you must meet your deductible before the plan begins to pay

- After your deductible, you pay a 20% coinsurance for covered services for the rest of the year

- In the Value HSA, if you enroll one or more family members, you must meet the full FAMILY deductible before the plan starts to pay expenses for any one individual.

- In the Super Value HSA, each family member needs to only meet the individual deductible and the plan will pay for that member.

- You can use HSA funds to help pay your deductible and coinsurance, if desired

- If you reach the out-of-pocket maximum, the plan will pay 100% of eligible expenses for the rest of the year

- In the Value and Super Value HSA, each family member needs to only meet the individual out-of-pocket maximum and the plan will start paying 100% of eligible expenses for that member.

If you have any funds left in your HSA at the end of the year, they will roll over into the next year and can help cover future covered expenses.

About the HSA

An HSA is a tax-advantaged savings account available to you only if you enroll in the Value HSA or Super Value HSA. It allows you to set aside pretax dollars to cover certain qualified out-of-pocket health care expenses. The HSA offers a triple-tax advantage and the ability to plan for health costs over the long term—not just year-to-year. You can use your HSA funds to help offset your qualified health care expenses now, or save them for the future.

Triple Tax Savings*

- The money you put in is tax free

- Your savings grow tax free

- Any money you take out to pay for qualified health care expenses is tax free

* Refers to federal taxes. State tax rules vary. Consult with your tax advisor for more details.

Who Contributes to the HSA?

If you are a new hire, MAPFRE’s HSA contribution is deposited in one lump sum after the first of the month after you enroll. If you elect at Open Enrollment, MAPFRE’s contribution is deposited just after the first of the following year. There’s no vesting schedule for MAPFRE’s contribution. Once the account is funded, the money is available for your use.

If you were hired mid-year, the employer contribution will be prorated for the number of months remaining in the calendar year.

If you choose, you can also contribute to your HSA. You can start, stop or change contributions at any time during the year.

| Coverage Tier |

MAPFRE Contribution |

Your Max. Contribution |

2024 IRS Annual Limit |

|---|---|---|---|

| Value HSA (Individual / Family) | $500 / $1,000 | $3,650 / $7,300 | $4,150 / $8,300 |

| Super Value HSA (Individual / Family) | $1,000 / $2,000 | $3,150 / $6,300 | $4,150 / $8,300 |

If you are age 55 or older, you may make an additional $1,000 pre-tax catch-up contribution to your HSA each calendar year.

There is no lifetime maximum balance for an HSA and there is no limit to how much you can roll over from one year to the next.

Eligible Expenses

Qualified Expenses

Doctor’s visits, dental care, orthodontic treatments, vision care, eye glasses, counseling, prescription drugs, insulin, crutches, wheelchairs and more. Review the entire list at www.irs.gov/pub/irs-pdf/p502.pdf.

The recordkeeping of your HSA is up to you, and it is important to hold on to all receipts, records and other documentation as proof that the expenses you pay from your account are qualified medical expenses. You do not need to submit receipts to Fidelity.

Who is Eligible

Your dependent must be a tax dependent to reimburse their expenses through your HSA. These include:

- Your spouse

- Your domestic partner, only if they are a dependent under federal tax law

- Children who derive over half of their support for the calendar year from you, including stepchild(ren), foster child(ren), legally adopted child(ren) or grandchild(ren) who are under age 19 or under age 24 if a full-time student and who are not the qualifying dependent of another tax payer for the tax year.

Managing Your HSA

If you elect the Value HSA and Super Value HSA, you will be automatically enrolled in an account with Fidelity. You will receive additional information from Fidelity about accessing your HSA.

Your online account enables you to:

- View your HSA balance.

- Review your recent distributions.

- Manage how your HSA is invested.

- Manage beneficiary information.

Click here for more details.

Accessing Your Funds

When you take money from your HSA to pay for qualified health care expenses for yourself, your spouse and your dependents, it is tax free. You can use your Fidelity Debit Card to access your HSA funds.

Who is Eligible to Enroll?

If you are actively employed and you enroll in MAPFRE’s Value HSA or Super Value medical plans, you will be automatically enrolled in the HSA.

An employee enrolled in the HSA cannot:

- Be enrolled in Medicare (Part A, B, C or D—though your spouse can be enrolled in Medicare)

- Be covered under another health plan

- Be covered under a health care flexible spending account (FSA), either yours or your spouse’s (even if your spouse does not submit expenses for you)

- Have a carryover balance in a health care FSA

- Be claimed as a tax dependent on another individual’s tax return

- Be a veteran who has received medical treatment from the Veteran’s Administration within the last three months (except for preventive care, dental or vision care)

Other Advantages

- It’s all yours. All contributions are yours to keep year to year. There’s no “use it or lose it” rule, like with the FSAs.

- Choice. You decide whether to use your HSA funds toward qualified health care costs now, or to save these funds for use in the future. It’s your choice!

- Immediate ownership. You’re in control of the money you put in your account, and with MAPFRE’s contribution, you have access to it for health care expenses right away. This account belongs to you.

- Investment options. You can choose to invest in one of Fidelity’s more than 10,000 mutual funds, stocks, bonds or CDs – all monitored by Fidelity’s investment professionals. And don’t forget, it’s still on a tax-free basis.

- Easy withdrawals. It’s your account, so you can use the money when and how you want for qualified health expenses.

- Portability. If you leave MAPFRE for any reason, including retirement, your HSA balance stays with you.

Do You Have Enough Saved?

It Pays to Plan Ahead! Social Security is meant to supplement only 20-40% of your preretirement income. Fidelity estimates that a 65-year old couple enrolled in Medicare and retiring in 2023 will need $315,000 in retirement funds to cover health care expenses in retirement. An average single person may need $157,500 saved to cover health care expenses in retirement. HSA savings can help!

Medical Benefit Summary

The following charts provide an overview of benefits payable under each of the BlueCross BlueShield medical plans. Benefits may be subject to restrictions and limitations. Be sure to refer to your Summary Plan Descriptions for more complete information on plan benefits.

EPO

| Medical Benefits | EPO Plan |

|---|---|

| Deductible In-Network | $1,000 Ind. / $2,000 Family |

| Out-Of-Pocket Maximum In-Network | Includes deductible, coinsurance and copays $5,000 Ind. / $10,000 Family |

| Coinsurance In-Network | 80% |

| Lifetime Max | Unlimited |

| Preventive Care In-Network | Plan pays 100% |

| TeleHealth/Virtual Visit In-Network | $30 Copay |

| Physician Office Visit In-Network | $30 Copay |

| Specialist Office Visit In-Network | $50 Copay |

| Basic Lab & Radiology In-Network | Plan pays 80%* |

| Emergency Room In-Network | $200 Copay |

| Urgent Care In-Network | $30 Copay |

| Major Lab & Radiology (MRI/CT/PET) In-Network | Prior Authorization Required Plan pays 80%* |

| Inpatient Hospital In-Network | Plan pays 80%* |

| Outpatient Surgery In-Network | Plan pays 80%* |

| Prescriptions Network Retail Pharmacy Network Mail Order (90-day supply) | No Deductible $5/$25/$50/$75/$75/$150 $10/$50/$100/$225/NA** |

| *Plan pays after deductible is met. **Specialty medications are only available in 30 day supplies from one of 4 preferred BCBS specialty pharmacy partners. Contact BCBS for more details. |

Value HSA

| Medical Benefits | Value HSA Plan |

|---|---|

| Deductible In-Network | $1,600 Ind. / $3,200 Family |

| Out-Of-Pocket Maximum In-Network | Includes deductible, coinsurance and copays $5,000 Ind. / $10,000 Family |

| Coinsurance In-Network | 80% |

| Lifetime Max. | Unlimited |

| Preventive Care In-Network | Plan pays 100% |

| TeleHealth/Virtual Visit In-Network | Plan pays 80%* |

| Physician Office Visit In-Network | Plan pays 80%* |

| Specialist Office Visit In-Network | Plan pays 80%* |

| Basic Lab & Radiology In-Network | Plan pays 80%* |

| Emergency Room In-Network | Plan pays 80%* |

| Urgent Care In-Network | Plan pays 80%* |

| Major Lab & Radiology (MRI/CT/PET) In-Network | Prior Authorization Required Plan pays 80%* |

| Inpatient Hospital In-Network | Plan pays 80%* |

| Outpatient Surgery In-Network | Plan pays 80%* |

| Prescriptions* Network Retail Pharmacy Network Mail Order (90-day supply) | $5/$25/$50/$75/$75/$150 $10/$50/$100/$225/NA** |

| *Plan pays after deductible is met. **Specialty medications are only available in 30 day supplies from one of 4 preferred BCBS specialty pharmacy partners. Contact BCBS for more details. |

Super Value HSA

| Medical Benefits | Super Value HSA Plan |

|---|---|

| Deductible In-Network | $3,200 Ind. / $6,400 Family |

| Out-Of-Pocket Maximum In-Network | Includes deductible, coinsurance and copays $6,000 Ind. / $12,000 Family |

| Coinsurance In-Network | 80% |

| Lifetime Max. | Unlimited |

| Preventive Care In-Network | Plan pays 100% |

| TeleHealth/Virtual Visit In-Network | Plan pays 80%* |

| Physician Office Visit In-Network | Plan pays 80%* |

| Specialist Office Visit In-Network | Plan pays 80%* |

| Basic Lab & Radiology In-Network | Plan pays 80%* |

| Emergency Room In-Network | Plan pays 80%* |

| Urgent Care In-Network | Plan pays 80%* |

| Major Lab & Radiology (MRI/CT/PET) In-Network | Prior Authorization Required Plan pays 80%* |

| Inpatient Hospital In-Network | Plan pays 80%* |

| Outpatient Surgery In-Network | Plan pays 80%* |

| Prescriptions* Network Retail Pharmacy Network Mail Order (90-day supply) | $5/$25/$50/$75/$75/$150 $10/$50/$100/$225/NA** |

| *Plan pays after deductible is met. **Specialty medications are only available in 30 day supplies from one of 4 preferred BCBS specialty pharmacy partners. Contact BCBS for more details. |

Considering Your Options

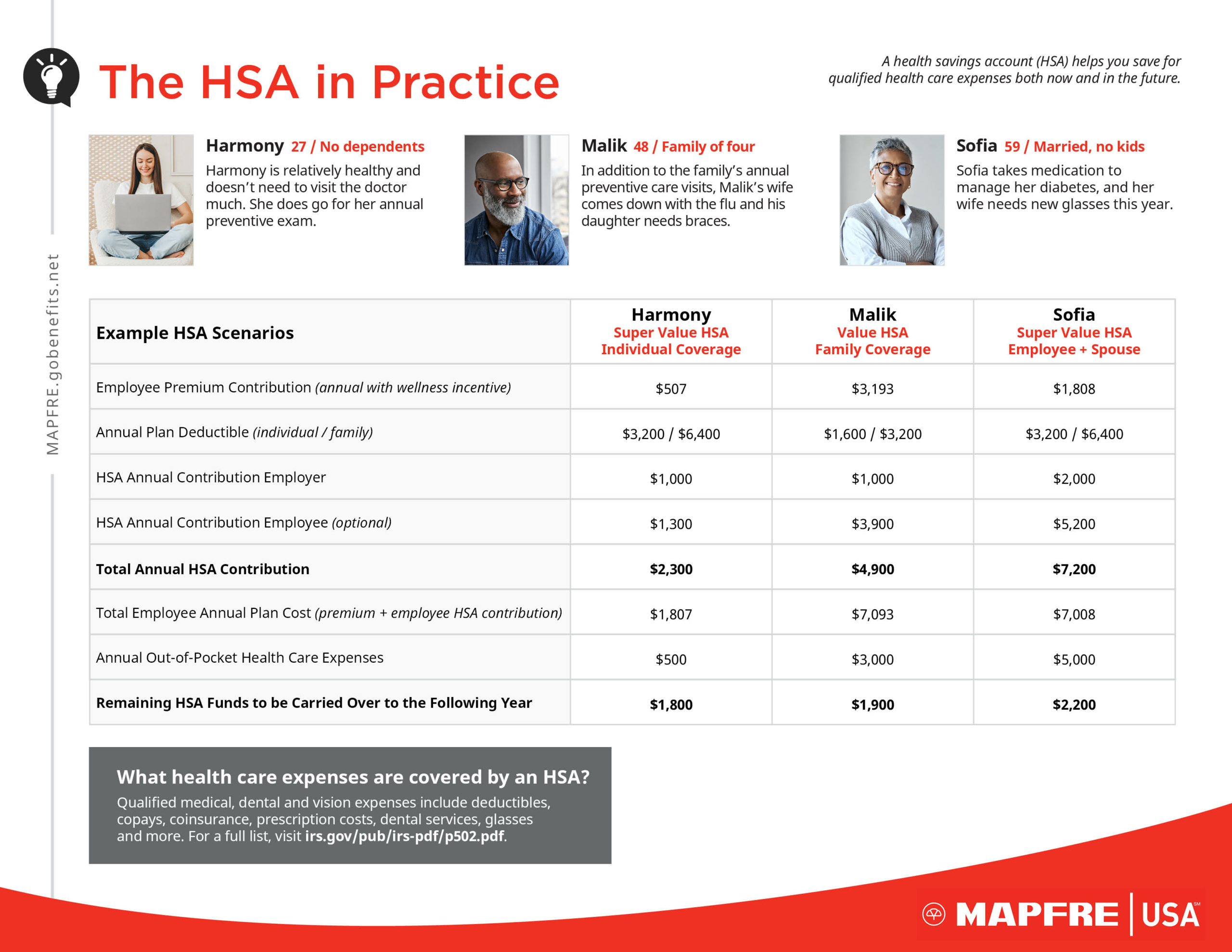

What benefits work best for you depend on your unique situation. Review the scenarios to see benefits in practice for different employees in different places in their lives.

Medical Plan Resources

Use these resources to maximize your medical benefits.

Find a Network Provider

To check if your doctor is in the network, or to find a new provider, visit member.bluecrossma.com/fad and:

- Enter a doctor, facility or specialty into the search bar, or browse by selecting “All Specialties”

- Enter your location

- Select the “Advantage Blue EPO” Network

- Click Search

Or, you can call BlueCross BlueShield member services at 800-262-2583.

Blue Cross Blue Shield Well-Connection

Access Care from Anywhere

Medical Plan members have access to care through the Well-Connection telemedicine service and can chat with a doctor from their phone, tablet or computer. When you have a health concern, you can connect with a board-certified and licensed physician in minutes. You pay only your regular PCP office visit copay per video consult.

Doctors can diagnose, treat and write electronic prescriptions for many conditions, including:

- Coughs and colds

- Sore/strep throat

- Flu

- Pediatric issues

- Sinus and allergies

- Nausea and diarrhea

- Rashes and skin issues

- Women’s health: UTIs, yeast infections

- Sports injuries

Convenient and confidential visits with licensed psychologists and psychiatrists to treat non-emergency care related to stress, depression and other behavioral health issues are also available.

Blue Cross Blue Shield of MA partners with American Well in providing the Well-Connection service. Sign up using your MyBlue App or by logging into MyBlue online at www.bluecrossma.org.

Summaries of Benefits and Coverage (SBCs)

MAPFRE’s Summary of Benefits and Coverage (SBCs) are available here. Please refer to these documents for detailed information and a complete list of benefits.

Setting Up An Online Account

The MyBlue website and App gives you an instant snapshot of your plan including information on coverage and benefits, claims and balances, medication lookup and more. Go to www.bluecrossma.org and click on the blue ‘Sign in’ button to register.

ID Cards

Look for your new ID card in the mail the month before your BlueCross Blue Shield coverage becomes effective. New hires will receive their ID card in the mail shortly after they enroll.

International Travel

You and your enrolled family members are covered for urgent and emergency care while traveling outside of the U.S. All other services outside of the U.S. are not covered as they are considered out-of-network. When inpatient care is needed, it is important to notify Blue Cross Blue Shield by calling BCBS Global Core Services Center at 1-800-810-2583 or collect at 1-804-673-1177.

Payment for urgent and emergency care outside of the U.S. is paid out-of-pocket and then reimbursed to you. You must file a claim form to be reimbursed. The claim form must be submitted with an itemized bill from the provider or facility. Click here to access the International Claim Form.

For assistance contact Blue Cross Blue Shield Global Core at:

1-800-810-2583

mapfreusa.com